Weekly Energy Market Update: Wholesale Gas and Power (21st October 2024)

- Lee Guttridge

- Oct 21, 2024

- 2 min read

Welcome to our weekly energy market update. As we approach the colder months, understanding the shifts in wholesale energy prices becomes crucial for businesses managing their energy strategies. This week’s market report highlights some key developments in both the gas and power markets.

Wholesale Gas Market Overview

This week, UK wholesale gas prices have seen a bearish trend, largely driven by positive supply outlooks. According to National Gas' winter assessment, supply levels are projected to be sufficient to meet demand, thanks to increased regasification capacity across Europe, which is up by 11% year-on-year. Additionally, the weakened demand for gas imports from the Continent and reduced industrial demand contribute to this downward pressure on prices.

However, a potential bullish driver on the horizon could stem from increased competition for Liquefied Natural Gas (LNG) shipments, with Japan considering boosting its emergency LNG supply needs to 12 cargoes annually. Furthermore, geopolitical factors, such as the expiration of Ukraine's gas transit agreement with Russia at the end of 2024, could introduce volatility in supply chains.

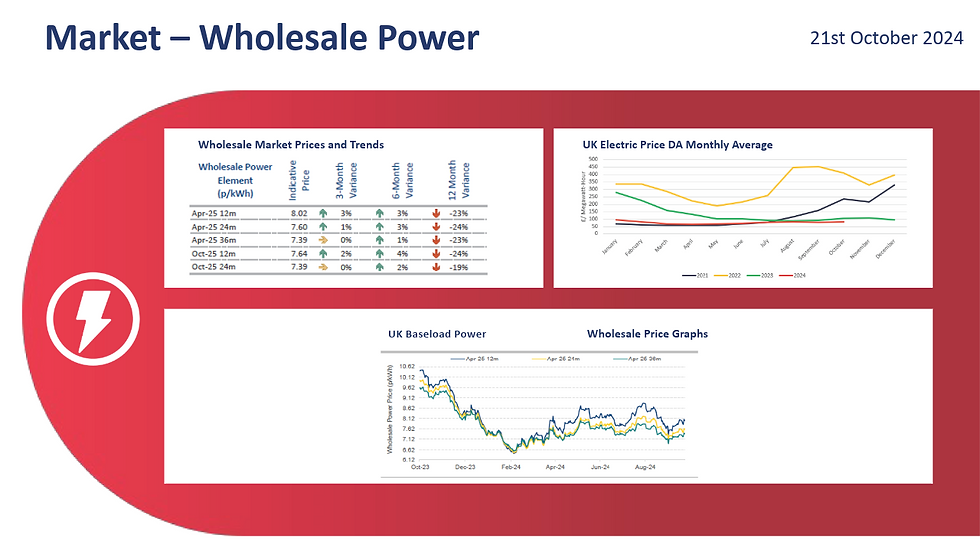

Wholesale Power Market Overview

In the UK power market, the outlook has similarly been bearish this week. New renewable energy developments, along with increased interconnector capacity between the UK and Europe, continue to put downward pressure on prices. Additionally, Norway's hydro reserves are above historical averages, ensuring steady power imports to the UK, further stabilising the market.

On the bullish side, there are concerns regarding upcoming UK power market reforms. The introduction of regional electricity pricing could negatively affect industries unable to relocate and pose challenges for renewable developers. In France, taxes imposed on EDF’s nuclear power revenues may hinder its ability to maintain aging nuclear infrastructure, which raises concerns over long-term power exports.

What Does This Mean for Your Business?

While both gas and power prices are trending downwards, several potential risks could create upward pressure in the near future. Businesses should keep an eye on the global LNG market, geopolitical developments, and the UK's proposed market reforms to ensure they are well-prepared for any price fluctuations.

Stay tuned for next week’s energy market update to stay informed on the latest developments impacting your energy costs.

Comments