Energy Market Update: Wholesale Gas and Power (December 2024)

- Lee Guttridge

- Dec 19, 2024

- 2 min read

As we close out the year, significant developments in the wholesale gas and power markets are shaping the energy landscape for businesses across the UK. Here's a breakdown of this week's key trends and drivers.

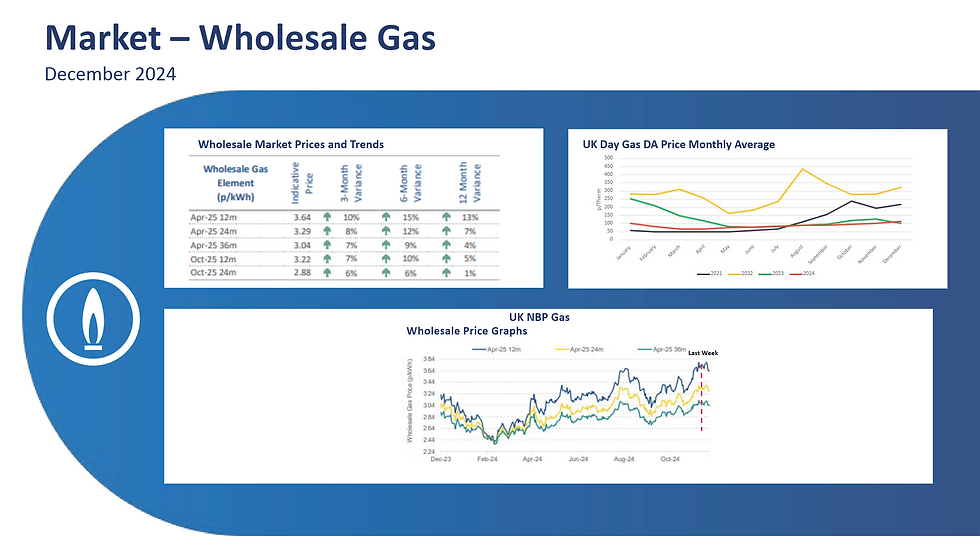

Wholesale Gas Market Update: Energy Market Update

The UK gas market remains influenced by a mix of bearish and bullish factors:

On the bearish side:

Russia has relaxed its gas purchase requirements, allowing European buyers to bypass restrictions on ruble-based transactions despite US sanctions on Gazprombank.

Geopolitical tensions in the Middle East are easing following the fall of Assad in Syria and setbacks to Iranian and Hezbollah capabilities, reducing regional risks.

However, bullish factors persist:

European gas storage levels have dropped significantly, falling from 95% to under 83% due to increased withdrawals driven by colder weather. With further drops expected reliance on stored gas could grow.

Colder conditions in Asia are increasing LNG competition, potentially straining European gas supplies.

Geopolitical risks linked to the Russia-Ukraine conflict remain heightened, with concerns over potential attacks on gas infrastructure leading the US to deploy jets in Scotland for the first time since the Cold War.

Wholesale Power Market Update

In the UK power market, contrasting bearish and bullish signals are influencing trends:

On the bearish side:

EDF has extended the lifespan of four nuclear reactors, adding 2.4GW of low-carbon capacity through 2026, supporting the UK’s clean energy transition.

The UK has committed to a 95% clean power target by 2030, reinforcing investment in renewables and streamlining planning processes to meet this ambitious goal.

On the bullish side:

The collapse of the French government is causing instability, with debt-related challenges at EDF threatening its ability to maintain power exports to Europe. This could lead to tighter supply across the continent.

Small Modular Reactors (SMRs) are gaining traction globally, offering a scalable, low-carbon alternative to fossil-fuel-based power generation. While these reactors may ease renewable energy challenges, their build-out could affect power pricing in the long term.

Implications for Businesses

For businesses, these trends highlight the importance of strategic energy procurement and sustainability planning. The drop in European gas storage levels, growing LNG competition, and geopolitical risks suggest potential price volatility for gas. On the power side, developments in nuclear energy and renewable commitments present opportunities to secure cleaner, more stable energy supplies.

Stay Ahead with National Business Energy

At National Business Energy, we provide regular Energy Market Updates, expert insights and tailored solutions to help businesses navigate these market shifts. From optimising energy procurement to exploring renewable options, we’re here to support your business’s energy goals.

Visit National Business Energy to discover how we can help you reduce costs, enhance sustainability, and adapt to the changing energy landscape.

Comments